You are getting bombarded with calls and letters due to owing back tax balances. Watch out for all the tricks companies use to solicit your business.

The IRS may issue a lien for back taxes owed. The IRS does this to protect their interest. Tax liens filed is public record. Once a lien is filed, anybody can look up your tax lien. There are many tax resolution companies that obtain lists of all tax liens filed. If the tax lien meets a certain criteria for business potential, the tax resolution company will use a number of tricks to get your business.

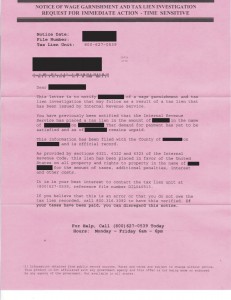

One of the tricks is sending out garnishment notices that look legitimate. Because tax liens are public record, the tax resolution company can use seemingly personal information to legitimize a the letter sent to you. Examples include your name, address, date of tax lien and the amount of taxes owed. All of this information can be obtained from the IRS tax lien filed in your county.

One of my clients frantically called me because they received a wage garnishment notice.

This notice had all the tricks to scare you into calling. The notice is red, it mentions the IRS, it says wage garnishment, the letter includes personal information on taxes owed, and it has some technical tax jargon. You are already nervous about owing taxes. Receiving this letter just triggers that nervousness so you will call the number.

If you receive one of these letters, just know that the letter is from a company soliciting for your business. Real IRS letters are not in red. IRS letters are clearly identified. There will be a large IRS logo on the top left hand corner of the letter. The addresses and phone numbers listed will be clearly identified as IRS contact information. There is no small print at the end of a IRS letter stating that the letter is not affiliated with any government agency. Finally, important IRS notices will be sent to you by certified mail.

Call us if you need assistance on fixing your tax situation. If there are any questions or concerns, call ALG Tax Solutions 855-MI-Tax-Help (855-648-2943), provide your contact information online, or click Ask Your Question.

IRS Circular 230 Disclosure: To the extent this writing contains advice on a federal tax issue, the advice is not intended to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code, or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed in this communication.